Lululemon acquired in-home fitness equipment brand ‘Mirror’ in 2020 to leverage a “hybrid workout model” for its customers. Three years later, the athleisure brand is now exploring selling Mirror because hardware sales missed its sales projections. The company is also looking to relaunch its digital and app-based offering Lululemon Studio (which was also launched in 2020) replacing its previous hardware-centric positioning with digital app-based services.

But what kind of fitness equipment do the company’s customers prefer purchasing?

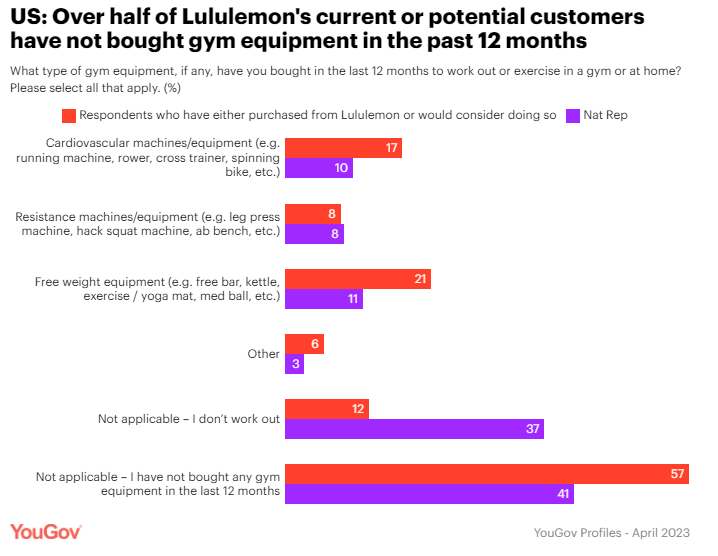

According to YouGov Profiles - which covers demographic, psychographic, attitudinal and behavioral consumer metrics - 57% of Lululemon’s US current customers or Americans who would consider purchasing from the brand have not bought any gym equipment in the last 12 months. Among those who have, 21% opted for free weight equipment. By comparison, 11% of the general US population has bought this kind of gym equipment in the last 12 months to work out and exercise in a gym or at home.

Further, 17% of Lululemon’s audiences and 10% of the general American population bought cardiovascular machines or equipment like spinning bikes.

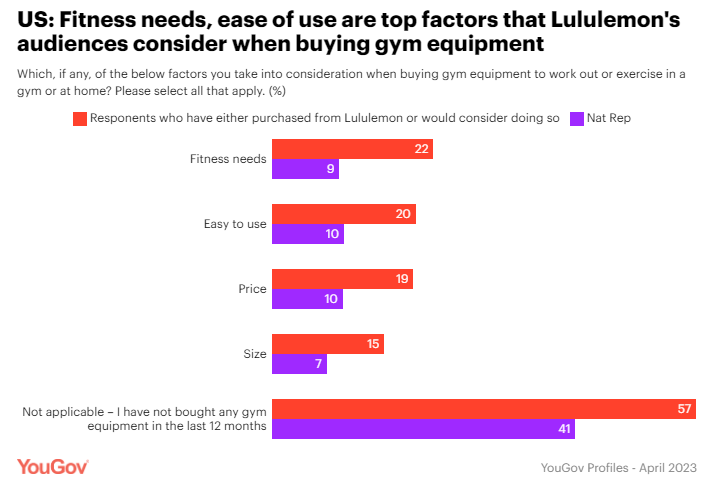

We also explore YouGov data to see what factors they consider when buying gym equipment to be used in the gym or at home. Profiles data shows that fitness needs and the ease of using gym equipment are top factors this group considers when buying gym equipment (22% and 20% respectively).

For the general American population, the ease of using gym equipment and price are most important factors when buying gym equipment (10% each).

Further, 57% of Lululemon’s audiences and 41% of the general population have not bought any gym equipment in the last 12 months.

When it comes to the type of gym membership Lululemon’s audiences currently have, 40% work out on their own. Another 32% have a gym membership and 15% of them have an online or at-home paid subscription for a fitness plan or workout classes. Around 13% of this audience has subscriptions for a specialty studio or a specific class like kickboxing and spinning.

Profiles data further shows that 88% of Lululemon’s current customers or those who would consider shopping from the brand agree with the statement that they “aspire to the idea of being fit and healthy.” The brand’s customers, 80%, agree with the statement that “it’s important for (them) to be physically active in (their) spare time” and 78% of them agree that they wished they “exercised more.”

In addition to athletic apparel, Lululemon also offers accessories like heart rate monitors via its sub brand, Lululemon Studio. According to Profiles, 76% of Lululemon’s audiences agree with the statement that “wearable devices can encourage people to be more healthy.” But 60% of this group also agrees with the statement that “wearable technology is too expensive.”

Post time: Aug-02-2023